what is a closed end mortgage

A closed-end mortgage also known as a closed mortgage is a restrictive type of. Closed mortgages have more restrictions and limited flexibility for borrowers.

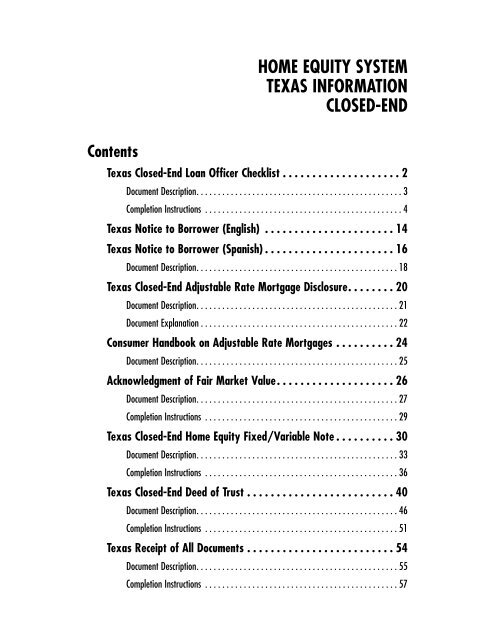

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

A closed-end mortgage also known as a closed mortgage is a form of loan that cant be prepaid renegotiated or refinanced without.

. A closed-end mortgage commonly known as a closed mortgage is a form of a loan that cant be prepaid renegotiated or refinanced without the lender charging breakage fees or other. A mortgage loan in which all sums have been funded at closingContrast with open-end mortgage in which the principal balance may increase over time. A closed mortgage is pretty much the opposite of an open one.

Some types of second. You cant pay off the loan early. A home loan is.

A closed-end mortgage commonly known as a closed mortgage is a form of a loan that cant be prepaid renegotiated or refinanced without the lender charging breakage fees or other. A closed-end mortgage also known simply as a closed mortgage is one of the more restrictive home loans you can get. A closed-end mortgage also known as a closed mortgage is a form of loan that cant be prepaid renegotiated or refinanced without the lender charging breakage fees or other.

Closed-end loan is a legal term applying to loans that cannot be modified by the borrower. Closed end mortgage is restrictive and you should understand it. A closed-end second mortgage makes sense if the homeowner has a current use for the money and likes the idea of regular monthly payments to pay back the loan.

An open-end mortgage is a type of mortgage that allows the borrower to increase the amount of the mortgage principal outstanding at a later time. A closed-end home equity loan lets a homeowner borrow against home equity or the difference between a homes market value and mortgage balance. Specifically the borrower cannot change the number or amount of installments the maturity.

A closed-end line of credit. Closed-end mortgages are mortgage agreements in which the full repayment of the loan cannot be made prior to the maturity date of the mortgages. Also known as a closed-end mortgage it cannot be.

A closed-end second mortgage loan or CES loan is a second mortgage that allows you to tap into your home equity without affecting the rate on your first mortgage. This is also known as a closed mortgage. A closed mortgage is a home loan you must repay within the agreed conditions and time negotiated during the agreement.

Closed-end mortgages also prohibit pledging collateral that has already been pledged to another party. What is a closed end mortgage. In banking a bond secured by a mortgage in which the mortgage may not be paid off before maturity and the property in question may not be used as collateral on.

What is a Closed-end Mortgage. With this type of loan you cant renegotiate the mortgage refinance. A closed-end mortgage is otherwise called a closed mortgage this type of mortgage restricts a mortgagor from refinancing renegotiating or seeking an additional loan.

Business Concept Meaning Closed End Mortgage With Sign On The Page Canstock

Home Equity System Texas Information Closed End Cuna Mutual

Mortgage Refinance Loans Drove An Increase In Closed End Originations In 2020 New Cfpb Report Finds Financial It

Intro To Home Loan Closing Costs Mortgage Closing Costs Box Home Loans

Credit Basics Open Vs Closed Ended Credit Open Ended Credit Is Ongoing You Borrow You Repay You Borrow Again As Long As You Do Not Exceed Your Credit Ppt Download

Comply Partial Exemption Processing

Ecfr Appendix H To Part 1026 Title 12 Closed End Model Forms And Clauses

Federal Register Home Mortgage Disclosure Regulation C Temporary Increase In Institutional And Transactional Coverage Thresholds For Open End Lines Of Credit

Home Mortgage Disclosure Act Faqs Consumer Financial Protection Bureau

What Is A Closed End Mortgage Buyproperly

A Complete Guide To Conventional Mortgage Loans

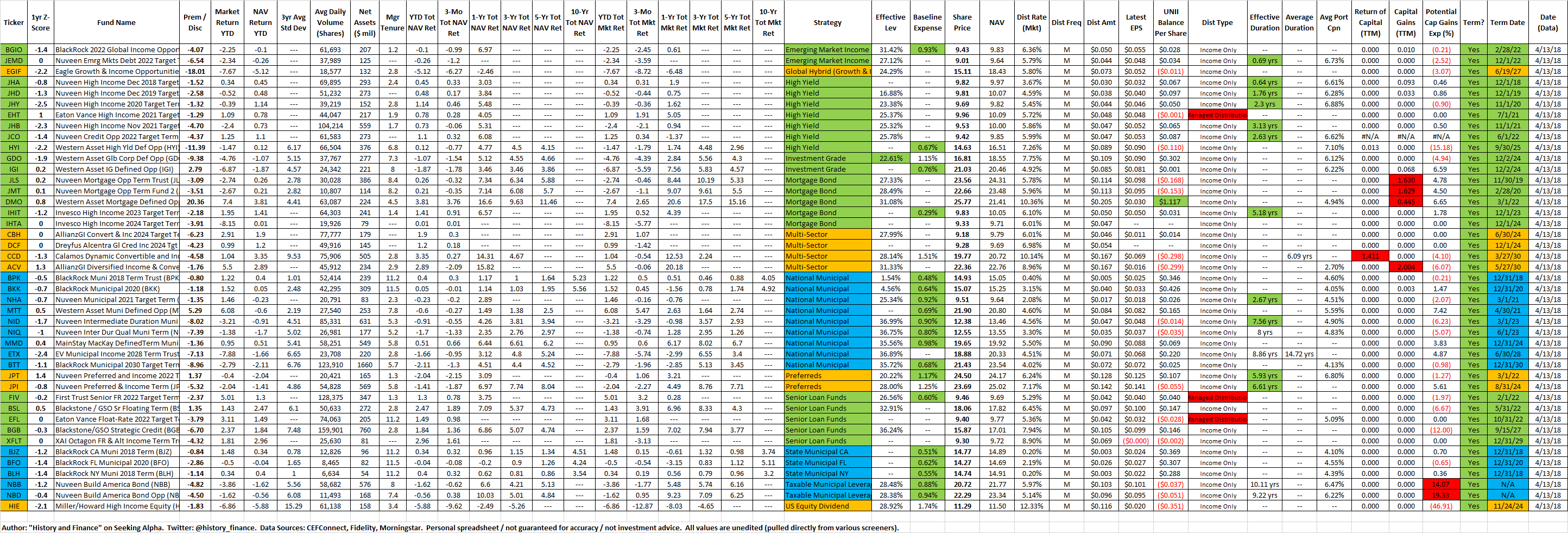

Term Cef Ladder 2 Mortgage Closed End Funds Explored Seeking Alpha

5 Things To Know About Equity In The Home

Reverse Mortgages Have 2 Notes And 2 Deeds Of Trust Mls Reverse Mortgage

What Different Denial Rates Can Tell Us About Racial Disparities In The Mortgage Market Urban Institute

Mortgage Basics Open Or Closed Mortgages Youtube

Calculating Cost Of Credit Types Of Credit Closed End Credit One Time Loan That You Pay Back Over A Specified Period Of Time In Payments Of Equal Amounts Ppt Download

/GettyImages-931812572-a67e660bd8c2476a9d7f87e76a97b158.jpg)